INVESTING IN EAST GRAFTON

MVP is investing nearly $500,000 in the Kimball Property in East Grafton in an effort to create a unit of affordable housing, create workshop space, expand access to 175 acres of forestland, and share the legacy of the Kimball Family, who owned the property between 1882 and 2019.

Major funding comes from NH’s Community and Development Finance Authority (CDFA), NH Land and Community Heritage Investment Program (LCHIP), NH Preservation Alliance through the 1772 Foundation, the Natural Resources Conservation Service (NRCS), and generous donations from people like you.

Thank you to the businesses that purchased tax credits!

THE PROJECT

1) Provide a unit of affordable rental housing in the Mascoma Valley.

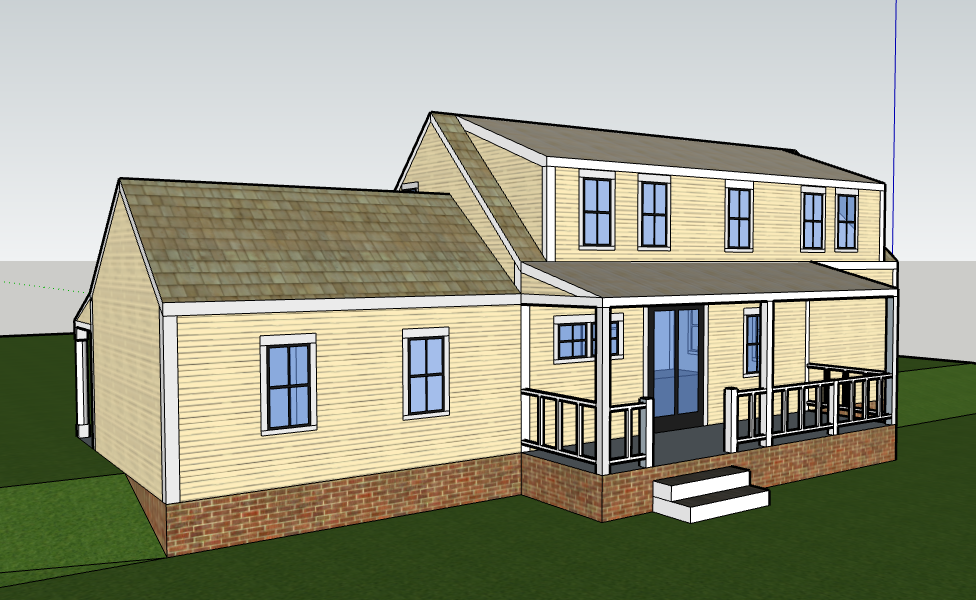

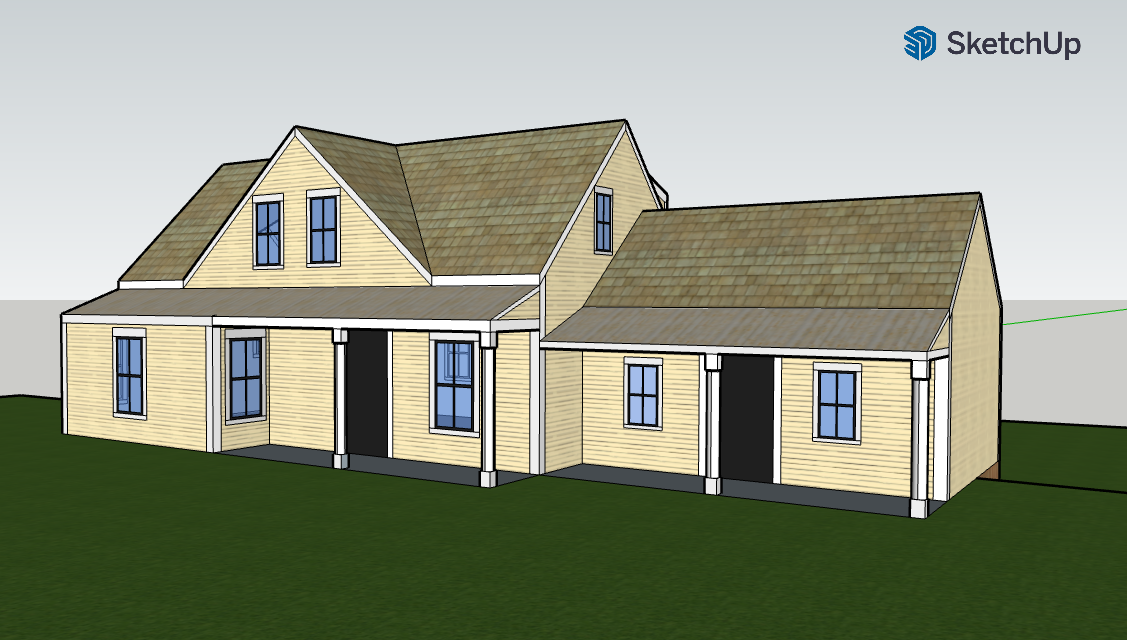

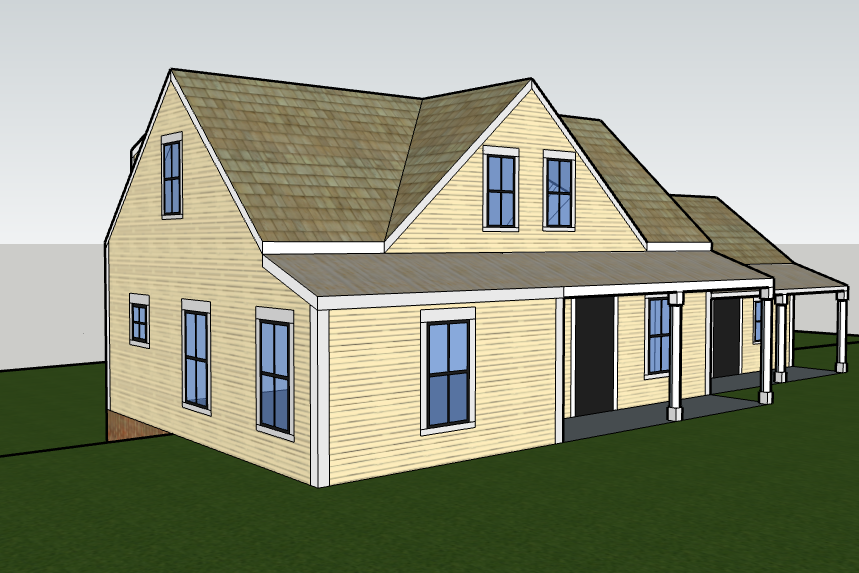

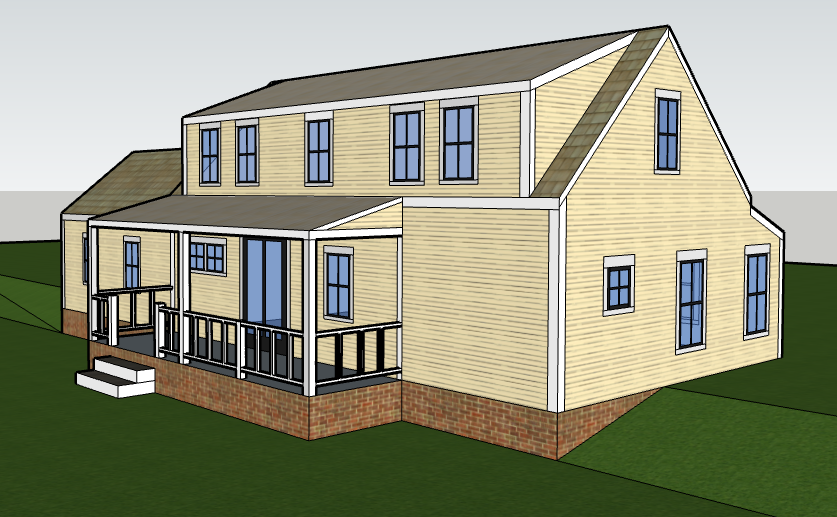

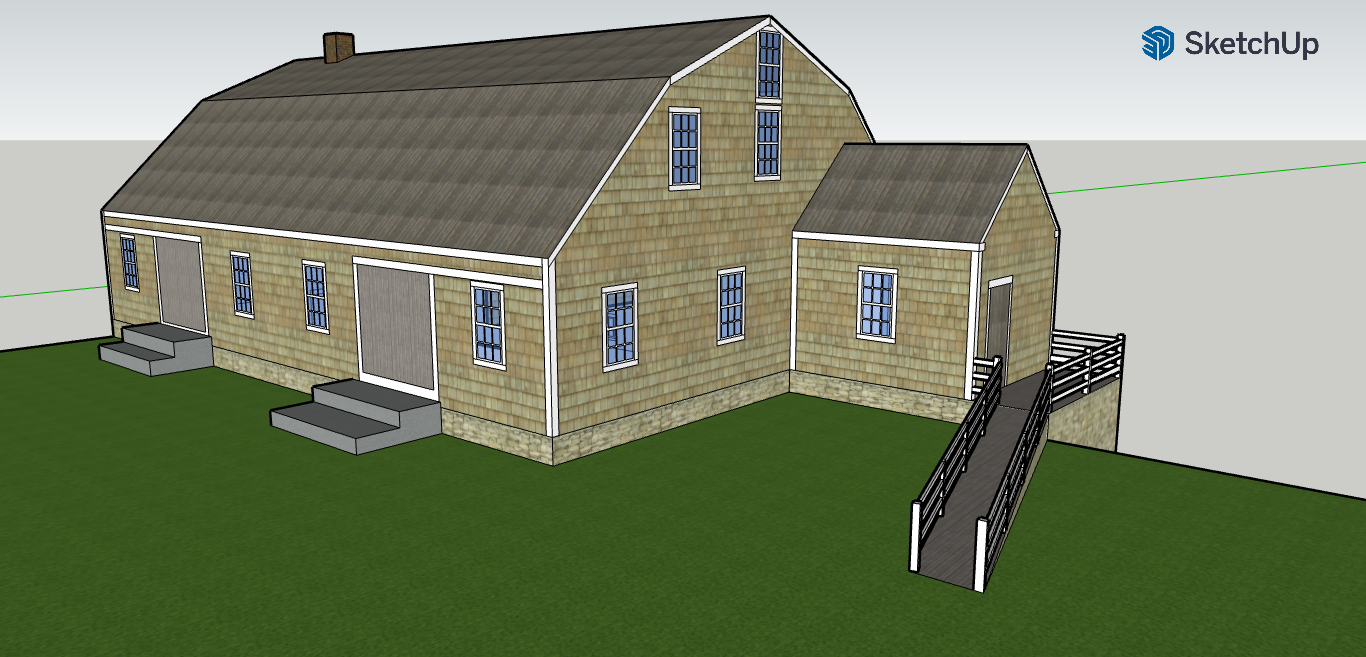

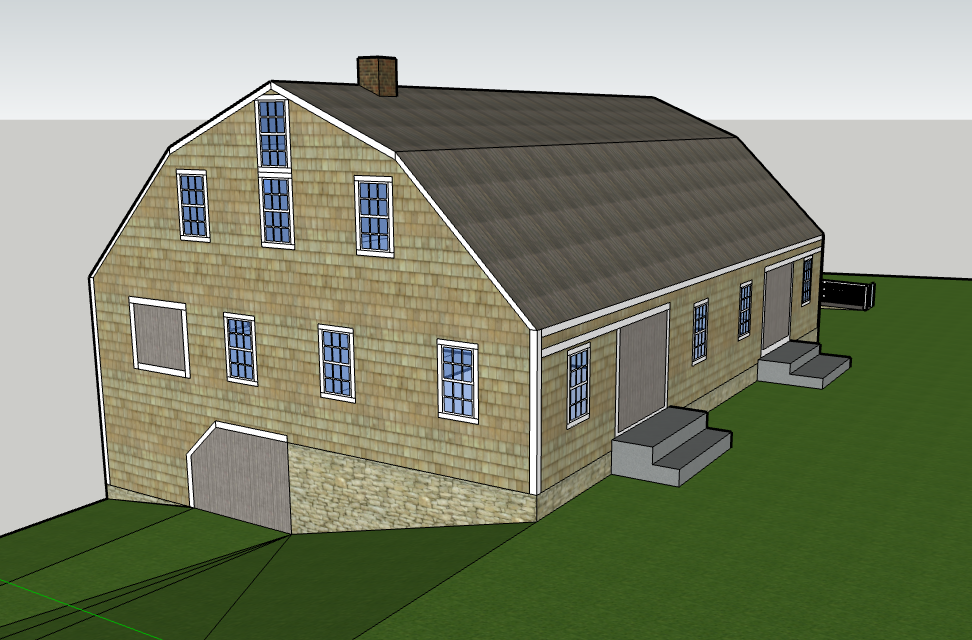

MVP will rehabilitate the Kimball house to return a much-needed unit of rental housing to the area.

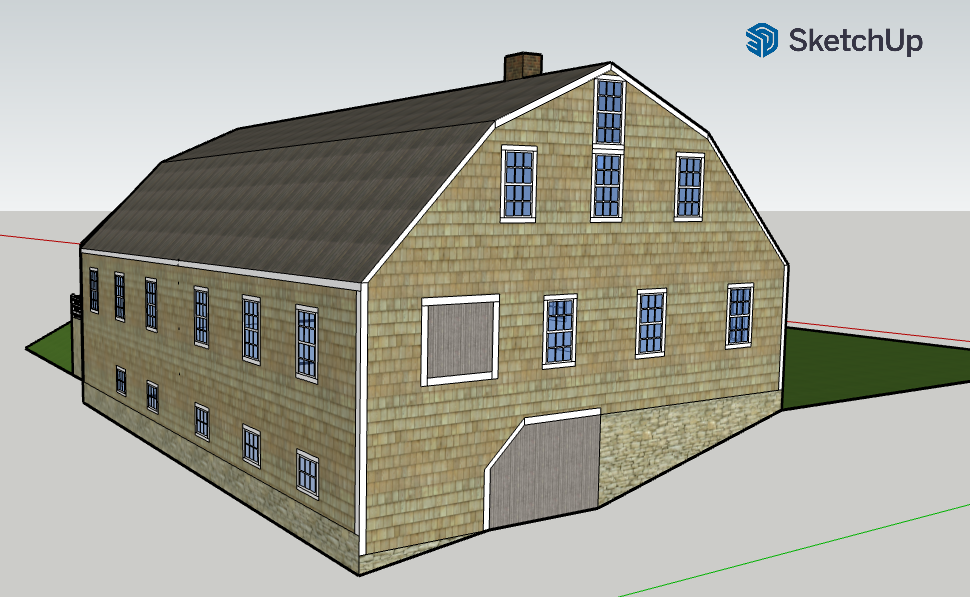

2) Provide flexible workshop space for the broader community in the Kimball Mill.

The largest building on the property will be converted into flexible space that can be used for workshop and demonstration space. The former shingle mill, built c.1890, offers a large open floor plan adjacent to the Mill Brook waterfall.

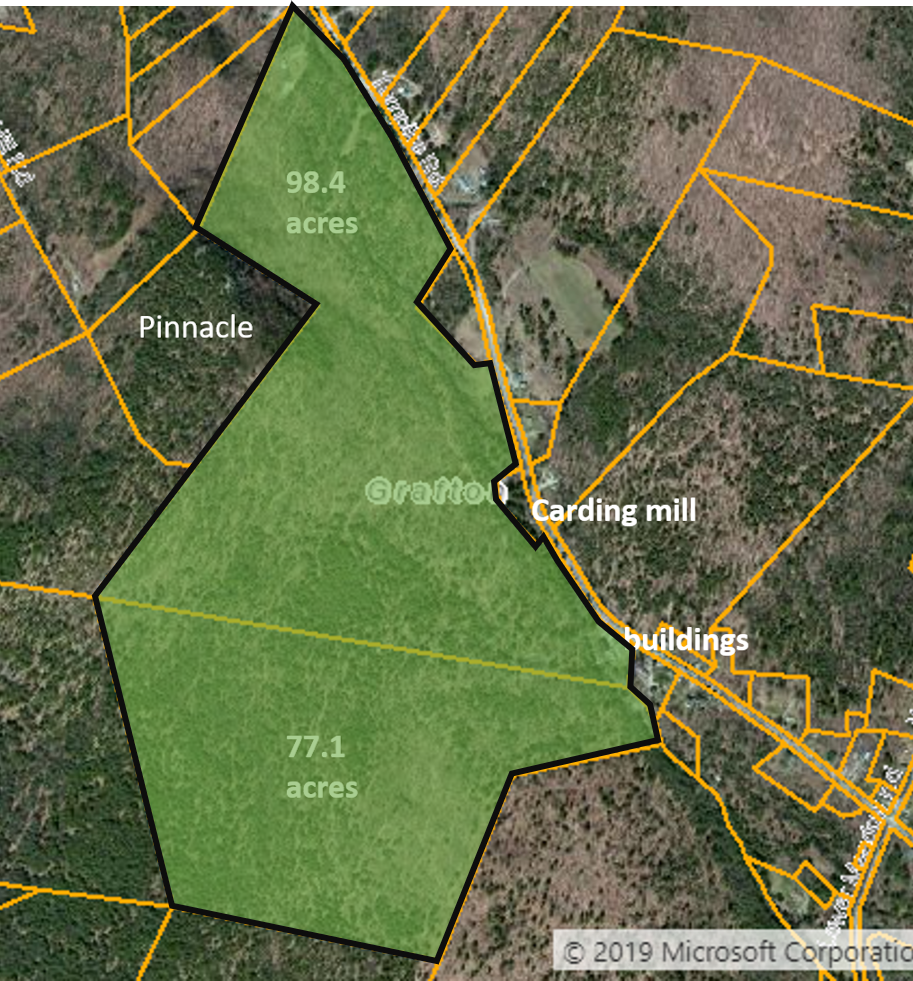

3) Provide access to 175 acres of forestland.

MVP is working with several partners to improve the health and recreational opportunities of the adjacent land. This includes developing a forest management plan (thanks to the USDA Natural Resources Conservation Service) and creating hiking/nature trails throughout the property.

Questions? Feel free to reach out to us. Want a tour of the property? We’re happy to arrange that as well.